The dates the installment payments were due.

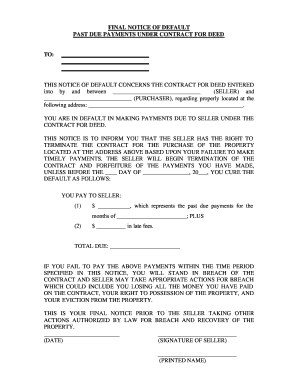

This is a legal document that states the following: Often, the first step is for the lender to send the borrower a notice of default. When a borrower defaults on a loan or promissory note and the lender wants to collect on the missed payments, the first things the lender should do is to read the promissory note and determine what procedures and steps are required when a default occurs. The promissory note itself should set out what constitutes default, so that both the lender and the borrower are clear on the terms. Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note. Defaulting on a loanĪ default on a loan happens when the borrower fails to make the scheduled payments in full. Each installment payment is usually made up of both interest and principal. The installment payments are of a set amount and are due on regularly scheduled dates, usually once a month, throughout the life of the loan.

When a loan has regularly scheduled payments, it is called an installment loan, since the borrower pays it back in installments. It includes the amount being borrowed, the length of the loan, and the amount of the payments, as well as other terms. Installment loansĪ promissory note is a legal document between a lender and borrower setting out the terms of a loan. This notice provides legal notice of the default, offers a chance for the borrower to make the missed payments, and states the lender's clear intent to take action to collect if the borrower does not catch up on the loan. When a borrower fails to make payments on an installment promissory note, a notice of default is usually the first response a lender uses to begin collection proceedings.

0 kommentar(er)

0 kommentar(er)